Toddler Room Environment

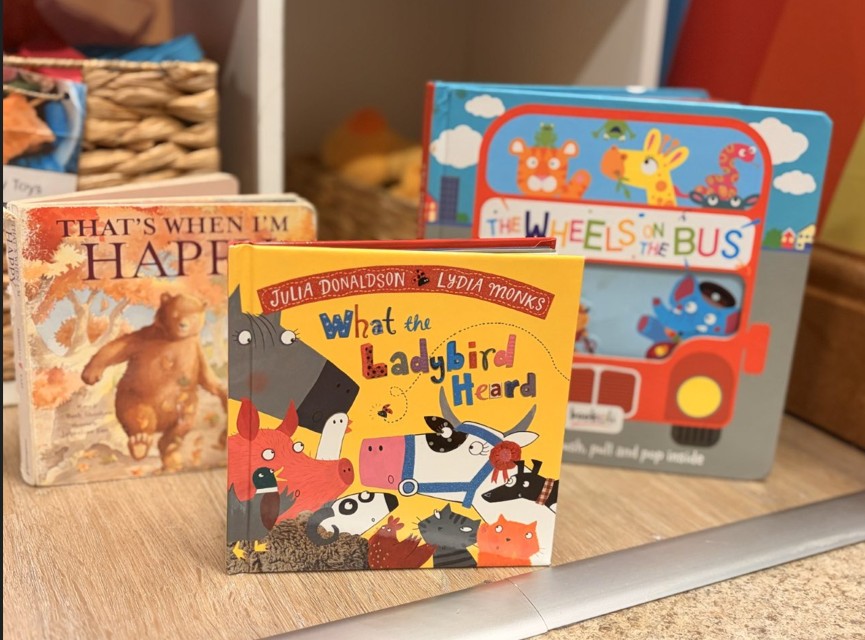

The open room allows children to freely access all of the environment and learning opportunities within each zone. Children love stacking foam bricks in the construction area, making dinner in the home corner, reading books and engaging in messy play and sensory activities.

Children begin to explore maths through jigsaws and sorting objects.

At this stage children begin to establish daily routines.